Money Pro for beginners or how to start expense tracking for the first time in your life

By Julia on Saturday, Apr 4, 2020

In the world of digital technologies it’s absolutely necessary to know about your own money: how much, on which account, on what purposes. Because there are way too many cards, accounts, loans, subscriptions, online purchases and so on. The money is split between ewallets and credit cards. Cash is no longer popular, which means we give away money even easier than in previous years, because we don’t sense the digital money as real. It’s all due to how our brain is organized - the digits we see on the screen remain just the digits for it. Therefore our debt is growing non-stop. A digital expense tracker is the solution that allows to live in the modern world rationally.

So, “why” we need to track expenses:

- to avoid spending on useless things;

- to keep timely records of all existing cards and cash;

- to pay off debts;

- to save money for a worthy goal.

WHAT USUALLY HAPPENS?

So, one day the idea comes to everyone: “On Monday I will start to live in a new way. I will take into account all expenses.” And off we go… Almost no one thinks of a finance app from the start. You build tables in Excel, you save checks during the day and in the evening you enter expenses at the computer. It is even nice in the beginning! Well, you’ve begun to control the money and kept the promise to yourself. And then the joy gradually disappears: the set of costs is expanding, the table has to be changed. The next month, the table is somehow very different from the previous month and comparing costs is not very convenient. Charts have to be built additionally and stored somewhere. In general, it requires more and more time which is already sorely lacking. There is a great danger of quitting the good practice without having received a proper result. In addition, Excel tables will not remind you of paying a mortgage or timely paying off a credit card and in order to bring all the cards together you need to make a separate record.

WHY Money Pro?

Money Pro is the very financial assistant that is simply necessary in today’s life. The app allows you to keep track of expenses with maximum comfort reducing time for boring bookkeeping.

Let me just put the pros you get by starting to control money using Money Pro:

- You do not think anymore about HOW it is better to keep records of expenses and income, everything is already well thought out for you;

- You record an expense once and it already affects the amount spent per day, the balances of your cards, and reports for different periods of time;

- You set recurring expenses once and the app automatically adds them every month;

- Plan important expenses in advance and set reminders for them: paying off a loan, mom’s anniversary, friend’s birthday, etc. The app will promptly remind you of necessary expenses.

- You can clearly see: how much money you spent today, how much per week, and how much per month.

Of course, the list can be continued but for a beginner these points are enough to understand the advantages of the app and to … START!

HOW TO START?

It seems it takes a long time to master the app. “How else? You need to read all the instructions.” - an inexperienced user will say. Not necessary at all. First, the Money Pro app is designed rather for intuitive use, so to speak, “take and use”; second, you will need instructions later when you already begin to enjoy money management and you’ll want a deeper look at your finances.

So, the first steps to working with Money Pro:

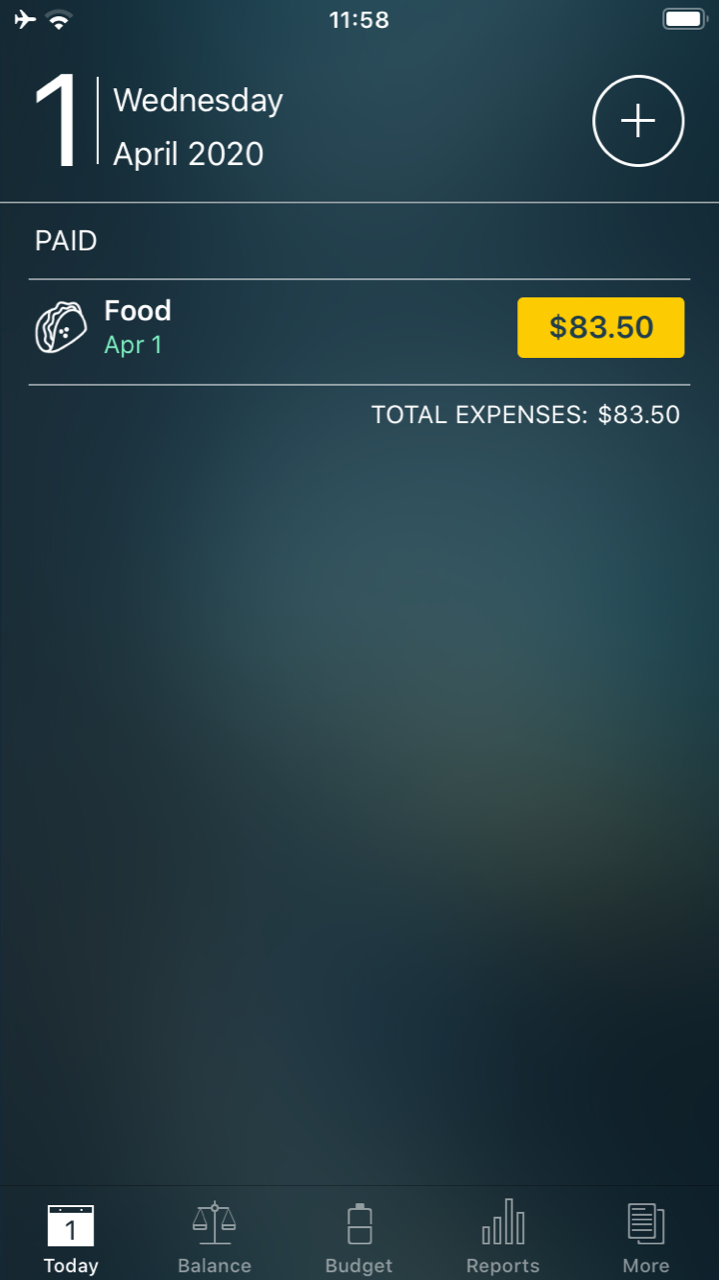

- Open the Today tab. You’re starting to use the program today, right? Tap the “+” in the upper right corner.

- By default, the transaction type is already set to “Expense”. The app offers you a number of categories that are convenient to track expenses with. Select the one you need. Perhaps it contains more detailed subcategories. Tap the one that suits you.

- Enter the amount of the purchase;

- Now tap the upper line with a wallet (account). You can track here cash, e-money, debit cards, bank accounts, credit cards, etc.

- You can create your first card directly in this form. Tap “Edit” in the upper right corner, then tap “Add” in the upper left corner. If you pay with a debit card or in cash choose Payment Accounts, if with a credit card - Credit Cards. In the new form fill in all the necessary data. Let’s suppose this is your debit card. Name it, select an icon, enter the today’s balance (excluding the current purchase), tap “Save” and then “Done”. Now select the account you’ve just created to pay for the purchase and save the first expense record.

At this point, on the Today tab, you can see your first expense record has appeared. But not only!

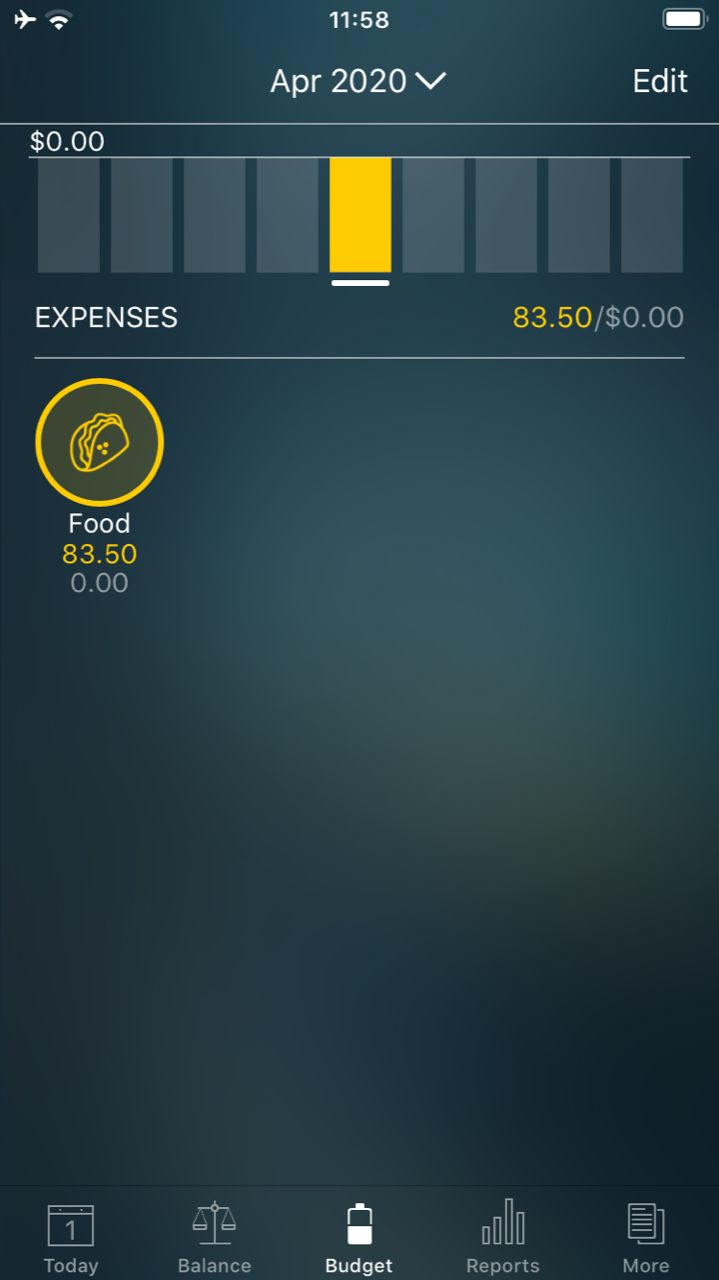

Let’s go to the Budget tab. A record of your expense is reflected here as well - a circle with the used category appeared. On this tab, you can track your expenses for the month. All of them are summarized in the upper right corner.

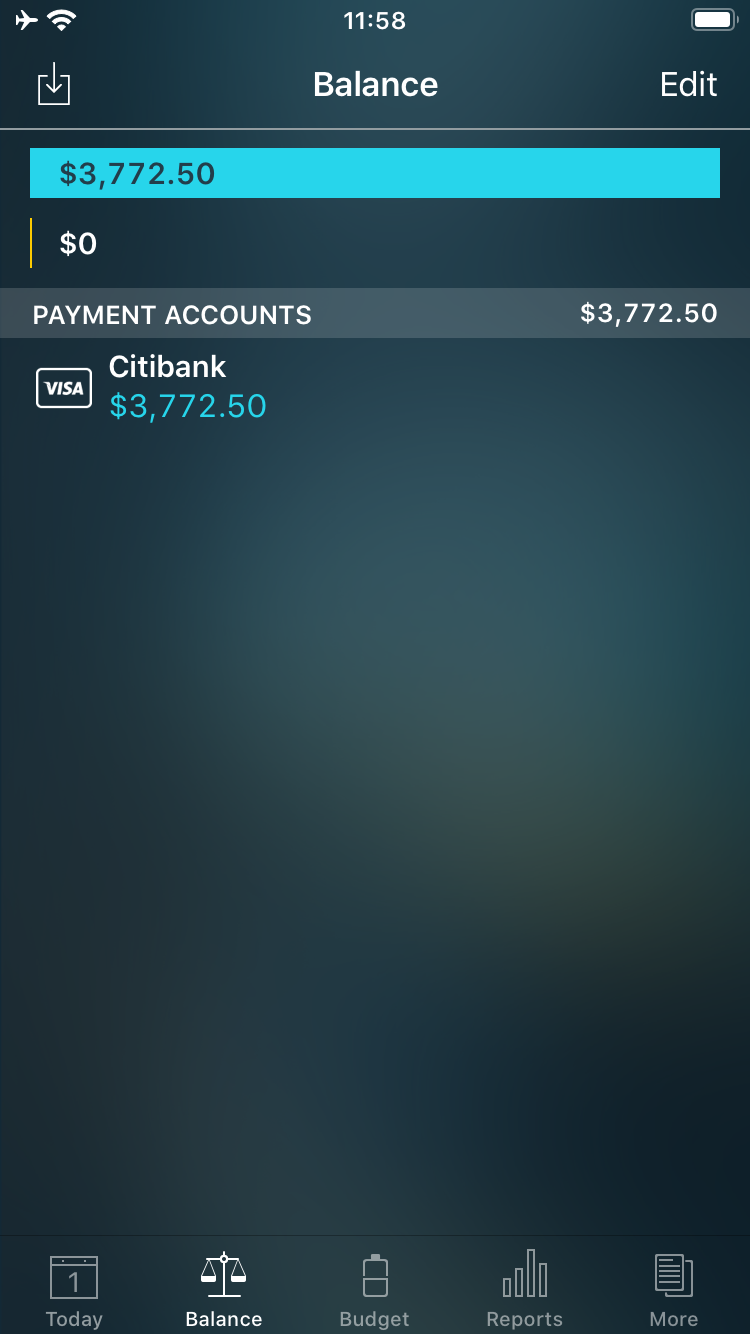

Now open the Balance tab. Here you will see the account you added to pay for the first purchase.

Then you can act differently. The app is very flexible and allows you to enter information from different tabs. If you want you can enter all your credit cards and bank accounts on the Balance tab. Tap “Edit”, “Add” and create as many accounts as you like. And then add today’s expenses directly from the Balance tab by tapping the account you need.

Or go to the Today tab and continue to add all the expenses of the day just as you added your first expense. In this case you will create the necessary accounts when adding expenses.

Well, are all the today’s expenses entered? Are all the accounts created? Congratulations! You can now receive valuable information about the state of your finances:

- on the Balance tab you will see the total amount of money that you have available;

- on the Today tab the Total Expenses line will show you the amount spent per day;

- on the Budget tab you will see the categories you spent on today.

Isn’t it convenient to see some generalized financial data in 10 minutes of work?

You say that you saw a lot more fields on forms? Of course! The app allows you to grow and improve your accounting. In the meantime, do not rush to clarify all the details - there’s a time for everything!

That’s all for now! Good luck!

Make sure to follow us on Facebook, X, and Instagram to stay updated.