Wrap up 2022 with Money Pro reports

By Yaro on Thursday, Dec 29, 2022

The year 2022 is coming to an end. It is time to analyze your expenses and plan for 2023! We are going to tell you about several useful features that will help you get the most out of your reports.

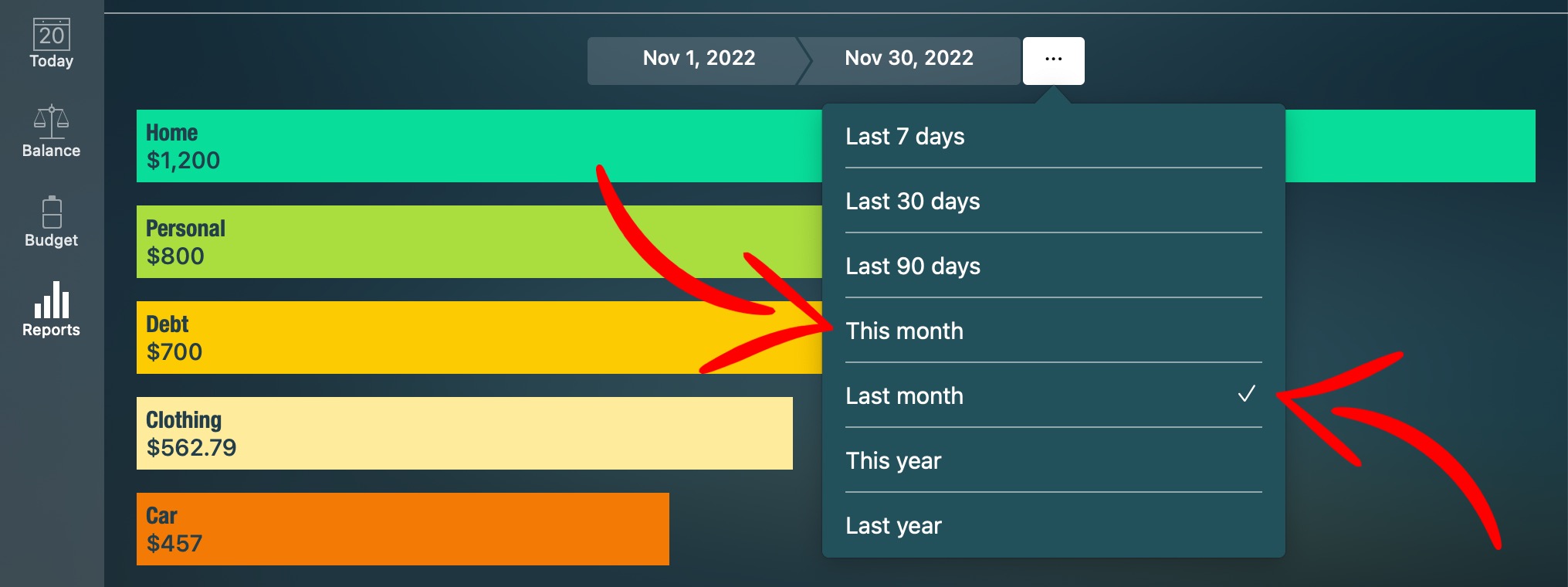

Expense categories. What did you spend on at the beginning of the year, and how much? At the end? Changes by category can be seen in the Income/Expenses report by selecting different periods. You can also set a custom date on the calendar with just a few clicks. Costs for several categories could change significantly. Or a new family member has arrived. View the report for several periods and conclude. Additionally, you can go to the Budget tab and select the category there. The bar chart, which is located at the top of the screen, will show the trend for that category for several periods.

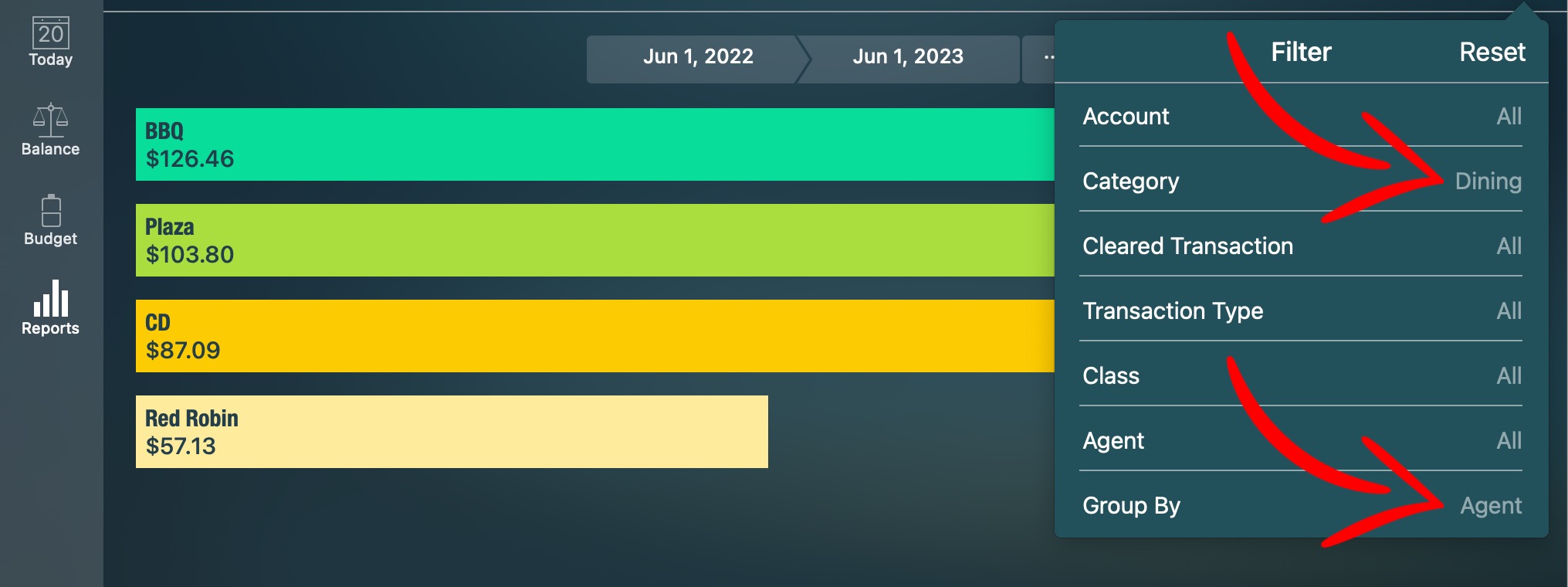

Group expenses by shops. The app has Agents or payees. If you use this feature, you can decompose any category by payees to see where exactly you were spending. Select a category in the filter and set the “Group by” option to “Account”. I dine or order food in different places, so I like to compare prices and quality in the Dining category in the long run.

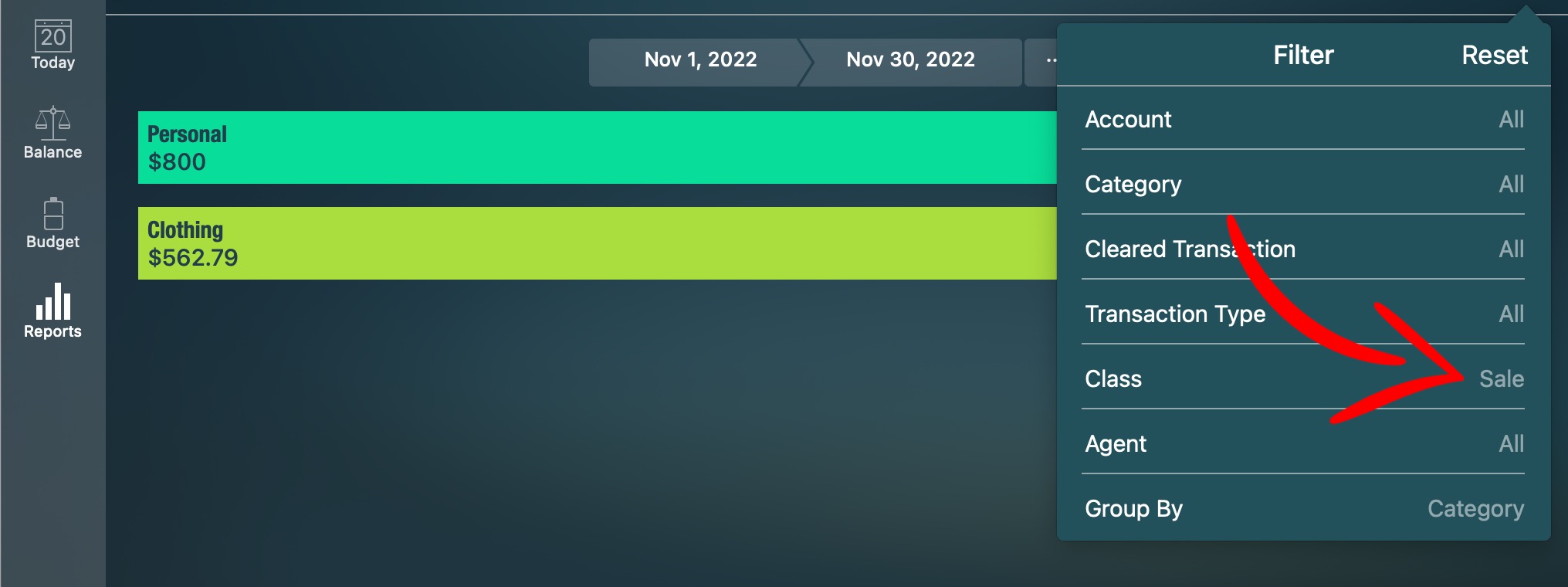

Good buys. To track sales, you can add a Class and set it in the filter of almost any report. This way, you can see what purchases you made on sales or special offers this year. You will be able to assess whether visiting the sale was a deliberate action to save money or whether you were attracted by a discount when the product later turned out to be unnecessary.

Impulse purchases. If you want to save money, your best bet would be to start with impulse purchases. I mean to get rid of them first😀 Create an additional Class for them so you can see what categories they belong to. This is seen in the long run, when one month won’t probably be significant, but the annual amount you spent will be because you could have spent it differently and gotten a lasting result.

Only numbers. The Transactions report shows as much information as possible in text format and helps you see if everything was entered correctly. A small transaction may be forgotten. Thus, comparing the report with your bank’s history is very helpful. It is also convenient to do it separately for each payment account. You can select the desired payment account in the filter.

Planning in advance. When you know there will be an annual payment for something in three months you can prepare for it gradually rather than paying all at once. The Projected Balance report will show you such payments. The Planned Transactions report shows your net balances going forward, so you know which month you can put some money away. Distribute your expenses evenly throughout the year and see how it looks on the report. It will ensure that your new financial year runs smoothly.

Start the new year with new Goals. Read more about Goals here.

If you have any suggestions, please post them here.

Happy New Year 2023!